2022 tax refund calculator with new child tax credit

As a result of the American Rescue Act the child tax credit was expanded to 3600 from 2000. This calculator is for 2022 Tax Returns due in 2023.

Us Child Tax Credit Calculator Expat Tax Online

Parents with higher incomes also have two phase-out schemes to worry about for 2021.

. The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the additional one-time goods and services tax. For example if a taxpayer has two. Enter the number of.

You can also create your new 2022 W-4 at the end of the tool on the tax return. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6. Tax Changes and Key Amounts for the 2022 Tax Year.

Enter the number of qualifying dependents aged 5 or younger age as of December 31 2022 for Tax Year 2021 including dependents or children born during 2022. Once you have a good idea of your taxes or if you just want to get your taxes done with start with a free Taxpert account and file federal. The latest round of federal stimulus was worth up to 1400 while the child tax.

Also you need to take into account additional child tax credit and stimulus money into account. We explain how the child tax credits could affect your taxes in 2022 Credit. The first one applies to the extra.

For 2021 only tax returns filed in April 2022 the Child Tax Credit for children under 17 changed in the following ways. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. Number of your children with age between 6 and 17 below 18 years old - you can receive up to 3000 for each one.

When the IRS issues refunds is out of your control - but you can avoid. Also you need to take into account additional child tax credit and stimulus money into account. Story continues below advertisement We absolutely.

The administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 14 of their Massachusetts Tax Year 2021 personal income tax. If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for.

Tax-General Article 10-913 requires an employer to provide on or before December 31 2022 electronic or written notice to an employee who may be eligible for the federal and Maryland. Please be aware that your children need to be under 18. This increases the maximum GSTHST credit amounts by 50 per cent for the 2022-2023 benefit year according to the bill.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. Families with 17-year-old children will be eligible to claim the Child Tax Credit for the first time under the new rule.

If your income is less than 150000 for married couples filing. If a taxpayer has more than one child who meets these eligibility requirements he or she can claim the child tax credit for each eligible child. The 2000 credit increases to 3000 for children.

The latest round of federal stimulus was worth up to 1400 while the child tax. However accepting the money as an advance could mean a tax shock in 2022 after the IRS.

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Easy Solar Tax Credit Calculator 2022 32

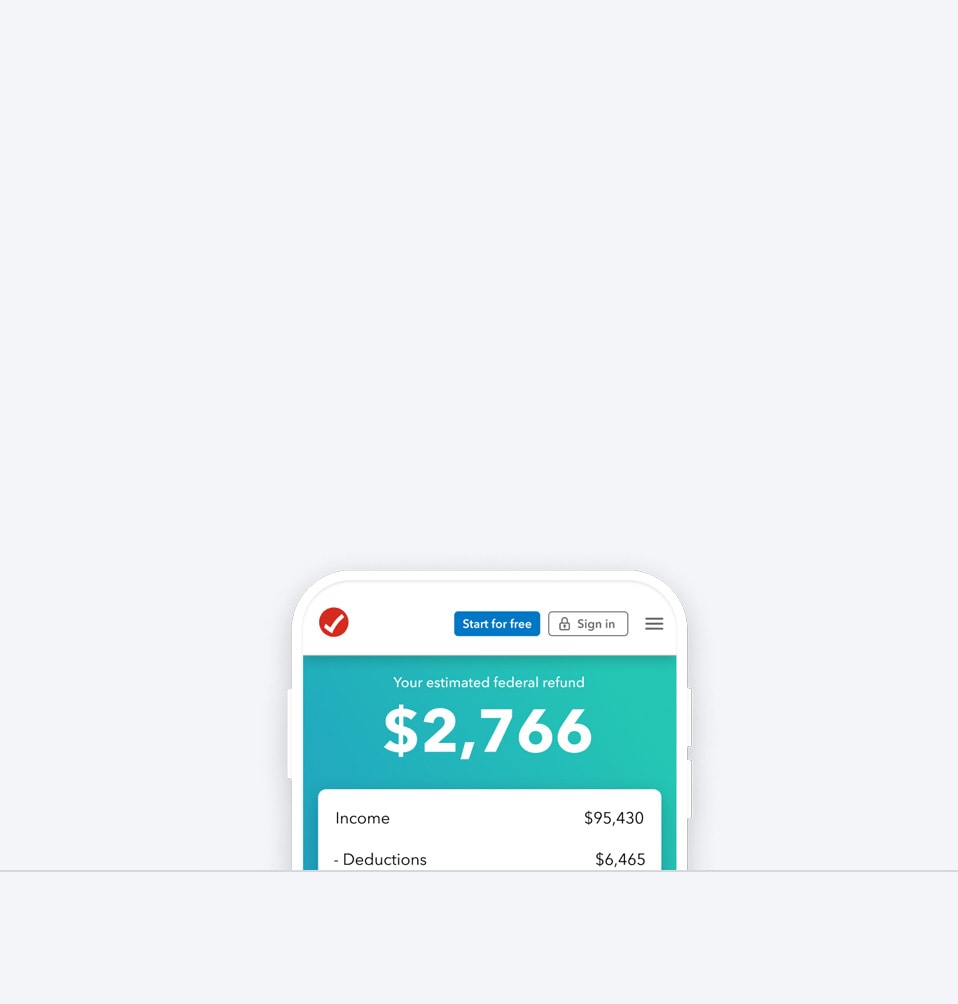

Income Tax Calculator Estimate Your Refund In Seconds For Free

2022 Tax Calculator Estimate Your 2023 Refund And Taxes

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Earned Income Tax Credit Estimator Get It Back

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

2022 Tax Calculator Estimate Your 2023 Refund And Taxes

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Tax Refund Calculator Estimate Refund For Free Taxslayer

Tax Credits For Your 2022 Tax Return The One You File In 2023

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor